BY ELINA KOLSTAD

BY ELINA KOLSTAD

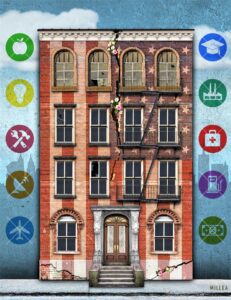

Many hoped that our city’s 2040 Plan would be a solution to our affordable housing crisis, the idea being that an increase in housing stock would drive down prices through the market pressures of supply and demand. In the wake of this global pandemic, any weakness in the housing market will most immediately decrease the construction of new housing of all types. As builders face uncertainty over whether units are likely to be bought or rented, investors will pull money from projects and construction will cease. Market forces will halt new construction, holding prices as high as possible. The market protects profits, not people.

In this moment, we are also seeing huge numbers of people losing their jobs with no way to pay rent or mortgages. At the national level, Rep. Ilhan Omar has introduced promising legislation to cancel rent and mortgage payments during the pandemic. The bill also includes two funds to compensate landlords and lenders for losses. https://omar.house.gov/sites/omar.house.gov/files/Omar%20-%20Rent%20%26%20Mortgage%20Cancellation%20Act%20-One%20Pager%20and%20Legislative%20Framework.pdf

Meanwhile, Congress is in recess until May 4, and Mitch McConnell is already bringing up the deficit and reducing spending, AFTER giving away, with no oversight, more than $3 trillion to corporations. Last I heard, rent and mortgage payments will still be due May 1.

In Minnesota, Gov. Walz ceased all evictions and foreclosures, but payments will be due once the crisis is over, merely pushing the problem forward. Many local city council members in Minneapolis, St. Paul and Richfield have signed a letter to Gov. Walz asking for an executive order that would suspend rent payments for the duration of our peacetime emergency. https://www.minnpost.com/state-government/2020/04/local-officials-call-for-canceling-rent-payments-in-minnesota/

The weakness with this proposal is that while it offers enforceable protection for renters, it merely suggests that lenders suspend foreclosures and late payment penalties. If homeowners and landlords are unable to pay their mortgages, we will see a slew of foreclosures once the governor’s peacetime emergency is lifted. This is not good for the overall economic health of our communities. Perhaps, more importantly, it puts tenants in greater jeopardy. Let’s be real, an individual landlord is more likely to work with a tenant who owes back rent and/or needs to renegotiate a lease than a bank owner will be.

The only way I could see this plan working is if the state is able to set up some sort of a mediation body that would negotiate payments between tenant, landlord and lender. The goal would be to achieve a lower payment or to refinance the landlord’s mortgage, with the requirement that the landlord then lower the monthly rent accordingly for either the duration of the lease or, ideally, sign a new 12-month lease at the lower rate. The upshot of this would be to lower rents going forward.

The problem is that legislation is already moving too slowly and people need help NOW. Another flaw with reducing mortgage payments to reduce rents is that many people have little to no income at the moment to pay any amount of rent.

A bill being worked on in the Minnesota House right now to use state government money to pay rents for those in need could provide a solution. Republicans in the state Senate are stalling action on this bill in hopes of limiting it to $30 million instead of the still probably inadequate $100 million put forward by the DFL-controlled state House. https://www.twincities.com/2020/04/22/coronavirus-legislature-housing-relief/

If the state is paying rents, the state has an interest in negotiating lower rents and mortgage payments in order to stretch the limited funds we have, and lenders and landlords should be willing to negotiate lower payments when the alternative would be no payment/default. I suspect, however, that there would need to be some sort of further action required to get lenders on board. To that end I would suggest that rules around foreclosure be tightened, for example, a moratorium on commencement of foreclosure procedures in the state of Minnesota for the duration, and not to be lifted until six months after the peacetime emergency ends.

Going back to Rep. Omar’s bill, it is noteworthy that, “The bill also seeks to create an optional fund to fully finance the purchase of private rental properties by nonprofits, public housing authorities, cooperatives, community land trusts and state or local governments in an effort to increase the availability of affordable housing.” https://thehill.com/homenews/house/493558-omar-introduces-legislation-to-cancel-rent-mortgage-payments-during-pandemic

We entered this global pandemic with an affordable housing crisis. This problem will explode if we don’t take the necessary concrete actions now. We also need to start thinking about housing differently. Housing is a human right and must be aggressively addressed. The need for quality, and truly affordable, housing was acute before. It will be overwhelming in the wake of this pandemic.